Antony N. Daviesa,b and Marian Draaismaa

aExpert Capability Group – Measurement and Analytical Science, Nouryon, Deventer, the Netherlands

bSERC, Sustainable Environment Research Centre, Faculty of Computing, Engineering and Science,

University of South Wales, UK

So, you are lucky enough to have some capital equipment funds available for a badly needed new spectrometer. You are under pressure to decide how best to invest this hard-won bounty. More importantly, you need to make sure that the investment will fulfil all the expectations of your team. Your justification for a particular instrument must stand up to tough scrutiny by your managers. Cold, hard, factual, analytical data can remove any impression of personal bias in the selection process and make the job of defending any decision, even to friends in unsuccessful supplier companies, much easier.

Why do we need the new spectrometer?... No… Really WHY do we need it?

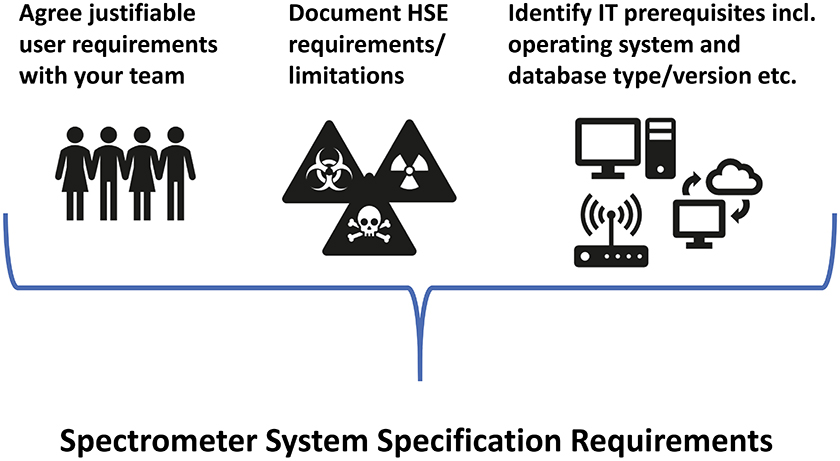

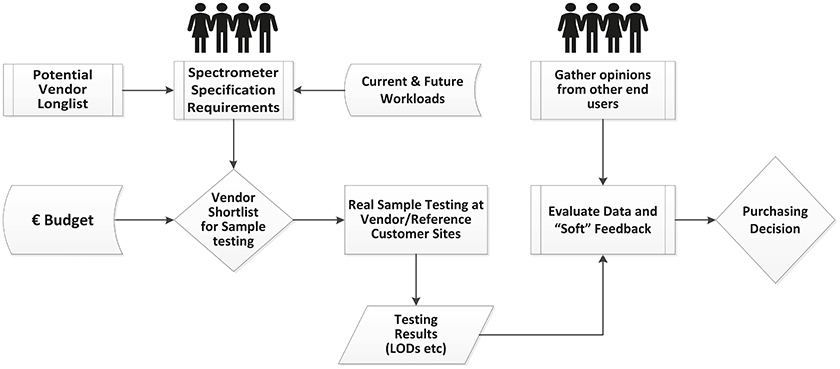

Fundamental to all spectrometer selection actions are the underlying user requirements and business case for the purchase. Without going into a long Fundamentals of Good Project Management sermon, it is good to get clear documentation of your needs. These can then be used as an impartial base for testing the various offerings in the market place. In fact, going through the process of arriving at these requirements is often extremely useful in firming up various colleagues’ opinions (and challenging their prejudices). It sets clear expectations at the beginning of the selection process.

This is the time when you may also need to focus hard on the “business case” in terms of cash numbers such as: we will be more efficient as we can run 10-times as many samples per week using a fifth of the expensive consumables. Quite often it is only these cash “return-of-investment” numbers which will interest senior decision makers. If they are not convincing, it will be hard to convince finance-oriented controllers just that a 10 % increase in optical resolution is a sound case for investment!

If you are looking to replace an existing spectrometer, checking what the real workload has been, what methods have been run and what was the range of samples analysed will be a good source of performance specifications. A second benefit of this check is that it can easily provide you with a source of real-world test samples which you can use later when assessing the performance of your shortlist of spectrometer candidates.

If the initial justification is work overload rather than the impending failure of an outdated model, it is often revealing to check the instrument logs. It is possible that the spectrometer itself is not measuring 24/7, so a good challenge would be to see if investing in a better/larger autosampler would suffice.

A few considerations BEFORE starting your search for your next spectrometer.

These arguments may vary depending on whether your company or university has good access to capital expenditure, but is light on staff/student numbers to use the equipment. If so, increasing the sample throughput per man-hour of work makes less sense than focussing on the quality of the outputs, as you do not have the numbers to keep your new investment running at optimal capacity. On the other hand, where you have excellent numbers of good analysts currently queueing to feed the spectrometer, but are short of cash to buy instruments, perhaps the speed of the individual measurement will be a critical factor and maybe the use of autosamplers to keep it running 24/7 will be the appropriate solution.

Having your requirements well documented at an early stage can also help to focus discussions later in the process, when some fancy add-on or additional software package is added to the considerations, but which was not part of the original arguments for the investment. This is not to say they should be ignored, but this does allow some impartial defence of excluding them from the assessment if required.

Computer control and deployed software

As you would expect from this column, the computing aspects of your requirements should be given particular attention from a number of different angles. Annoyingly, the dream spectrometer solution from the point of view of functionality may well come with an utterly hopeless user interface which will drastically reduce its efficient integration and operation in your team. It is also important to check your current computing specifications. If you have a well-run IT department, they should be able to supply you with a good roadmap of what and when compulsory changes to the environment are to be expected. If, for example, your chosen solution can only run with a specific database version and client operating system, this needs to be identified and checked against your internal IT deployment guidelines and roadmap. If you are working in a large organisation, especially in a heavily regulated industry, this is a must.

Again, it is important to think of your analysts and their interaction with the spectrometer software. Having a lab full of similar instrument types from a range of different vendors does mean, unfortunately, that it is hard to cover for staff holidays, absences for other reasons or when a particular spectrometer is out of commission for some reason. It is not great when the entire workload falls on a system which only half the staff can operate efficiently. This situation was worse in the past when vendors picked different operating systems from each other and even from instrument to instrument—maybe for good commercial reasons—but which made laboratory management a nightmare. Fortunately, this happens less now, but is still something to keep in mind. This is also a great area to get input from your team, as they may well have tales to tell about particular issues or instabilities they or their network of friends have found with particular solutions.

Finally, if you intend to purchase a spectrometer solution which is running a hyphenated method such as UHPLC-MS/MS with an autosampler, it is critical to see how the various components interact with one another. In some solutions, vendors fail to fully integrate the software to control the various components with each other. Maybe the autosampler runs as the main experiment control component and the spectrometer only receives a “Go” signal from the autosampler when a sample injection takes place. This can mean double the work for your analysts—programming the autosampler separately from the spectrometer and often having to use two separate interfaces. This can also be a potential source of serious errors if, for example, the sample lists are held separately from one another and not shared by both software packages. This sort of configuration can also make carrying out Design-of-Experiments based new method optimisation work a complete nightmare.

High level input decision-making criteria for your investment decision.

Required analytical figures of merit and your own “reference” samples

One mistake often made in looking at the choice of analytical instruments to invest in is to rely on measurements of reference sample mixtures measured by the vendor. Quite often, depending on the technique under investigation, reference mixtures of pure chemicals are commonly used to measure and check instrument performance in the laboratory. These might be a starting point, for example in checking that hyphenated chromatographic/spectroscopic instruments in a particular configuration is performing correctly. However, they should only be used as a starting point.

It is far more important to use the information from your current workload discussed above to identify “typical samples” from your own laboratory and standard methods that your team apply. Make good use of your team’s experience of how these samples behave and what performance to expect from them. Your standard matrix may contain high concentrations of salt, for example, so comparing measurements carried out on samples made up only in ultra-pure water may mask issues a candidate spectrometer has with high-salt content samples.

These test samples should be identified and enough material available for you to carry out your own round-robin amongst the vendors’ instruments that you are short-listing. In the past, really good data have been supplied by a manufacturer for industry-standard reference materials, but local requirements for the spectrometer were not to carry out sample quantification studies on the major components, but rather to look for and quantify very low level toxic contaminants in a complex and changing matrix where only tiny amount of sample were available. So, the performance of the complete analytical system right down at the limits of detection were critical. In one case, a vendor chose to collect scattered photons from a sample surface at a smaller solid angle than the competitor’s designs. This meant that although the main spectrometer itself was superb, it couldn’t match the Limit of Quantitation figures of the competitors—a key knock-out criterium for the selection.

Operational requirements and assessing the vendors

Armed with clear requirements, a range of typical, different and challenging reference test samples and, of course, some idea of your budget, you are now well prepared to venture outside your organisation and contact the various vendors in the market place. In some countries this may actually mean having to go through an “independent” systems integrator rather than the vendor themselves. This may be important when you come to assess the availability of future support for the instrument you intend to buy. This construct may not necessarily be a bad thing, experts who speak your own language and who are based more locally may well provide better support than thinly spread vendor engineers who are travelling from country to country every day. Local support may well be much cheaper if your maintenance contract requires you to pick up the cost of travel for a service visit.

Some spectrometers also contain, for example, radioactive sources and here it is important to identify your in-house rules/regulatory requirements around the movement of these sources. If your instrument needs to be returned to the vendor for maintenance or repair, how much additional trouble/expense will there be in the future, especially if that journey requires the instrument to cross national borders.

Having used your requirements to come to a shortlist of instruments and vendors on paper (remember any one vendor may actually have several models which can meet your needs), it is very desirable to actually see the spectrometers in action and your vendors—if they are seriously interested in selling you a solution—will only be too happy to oblige. This might be at their own sites or with good existing customers with whom they have an agreed relationship. Be very wary of a vendor with no demonstration facilities close enough for you to visit where you can run your samples and who also doesn’t have any reference customers in your area. For some instrument types, it is perfectly reasonable for the vendor to request your samples in advance of a visit, especially if you have chosen challenging samples of a type they have not seen before, as they will probably need to carry out the same method optimisation work in advance of the required measurements as you would do yourself. Saying that, a vendor delivered a very impressive performance with some samples one of our teams had been struggling to analyse consistently for several months, only to have the vendor’s engineer solve the problem in about 30 minutes! Definitely a lesson learnt!

Always ask for a reference customer list with named individuals who a vendor believes will be happy to talk to you. These may be too far from your location to visit in person, but a quick telephone call to gather their longer-term experiences with a particular vendor or solution. You may get excellent insights into the different options on the market place that you can never gain when running a few test samples over a few days. These contacts are a good source of confirmatory evidence on such topics as long-term cost of ownership, around replacing parts that wear out or solvent usage. Since the contact introduction comes from the vendor and you expect them to be positive, a good question can be “what do you wish you had known or had asked about before buying”?

Test the most important requirements on your own samples in a demo on the vendor’s instrument and compare the results of different vendors very closely. Do not rely on results only generated by the vendor of the instrument on standard reference mixtures.

Conclusions: the future

Having run all your reference samples on the various short-listed spectrometers, gathered all the feedback from other customers with the same solutions and, very importantly, listened hard to the thoughts of your own analysts, you also need to look beyond the current time point and into the future.

We have had issues in the past with the instrument selection process opting for a clearly superior product from a particular vendor, only for them to pull out of the market, de-listing the product we purchased within months of us installing it. An extremely annoying position to find yourself in and one which can be hard to foresee. You should be open with the vendor about their plans with this spectrometer type or field of analysis. The person you are talking to may themselves be unaware of thought processes higher up in their organisation, especially if decision-making control is from a headquarters located on another continent, but it is worth probing. Do they have a signed-off release plan, for example, for newer versions of the control software? Most major vendors will have this information and if you are under a non-disclosure agreement with them—which I would strongly recommend as they have been measuring your samples—they should be free to let you know. If they show you a good development roadmap, ask about their history of keeping to this roadmap in the past. This is a good indicator of the commitment of the company as a whole to this technology area.

Finally, it is in your interests and those of your vendor community to keep the results of your assessment and the data that drove the final decision confidential. Even for vendors you do not chose to purchase from, it is respectful to give honest and open feedback on your decision criteria as you will want them to be open and honest with you when the next purchase comes around and supporting you during your decision-making journey will have cost them money. Remember the feedback you provide can potentially help them improve their product offering which in the long-run can only help us all!